Can I DIY my retirement?

Last week I had the oil changed in my car. In his inspection report, the mechanic noted that my air filter and cabin air filter needed to be replaced and asked if I wanted him to do it for the cost of $89.98 plus tax.

Ever since college, I’ve been a penny pincher; my roommates and I developed a go-to meal consisting of canned tuna, the Knorr noodle packets, and white bread. So naturally, I declined the mechanic’s offer and planned to do it myself.

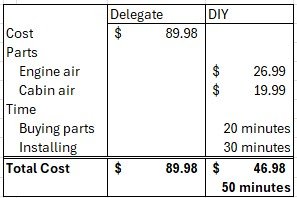

The table above compares the cost of delegating vs DIY. In terms of dollars spent, DIY saved me $43 and is clearly the superior option, but that’s not the whole story.

My time is worth something as well, and this project took me nearly an hour to complete. For one, the first parts store I went to had only one of the filters I needed, and I had to make a second stop to acquire both filters.

Installing the filters took time as well. When I worked at my dad’s auto shop, I had access to the best tool – namely, a battery-powered impact - to make quick work of the multiple bolts securing the air filter housing. In my home garage, however, I was left to screw and unscrew a half-dozen bolts by hand.

Also, I had to spend 5 minutes watching a YouTube video on how to open the access the cabin air filter behind the glovebox (and at least one minute cursing the engineer who placed the bolt).

You couldn’t put it a quarter inch higher!?

The three questions to ask yourself

Reflecting on this experience, I created a framework for evaluating these DIY decisions, and it comes down to three questions:

Do I have the expertise?

Do I have the tools?

Do I have the time?

In replacing the filters, I have the expertise and time to do the job well, but I don’t have the tools. I could buy a battery impact to make the job quicker and easier, but that costs money and I would have to store it somewhere (and my garage is cluttered enough already!)

To use a related example, some people like to change their oil in their garage or driveway. I have the expertise (from working at my dad’s shop) and the time, but, again, I don’t have the tools to make the job easy - a jack, jack stands, an oil pan, etc. Thus, that is a task I always delegate.

One more: you may be a person who owns a lawn mower and knows how to use it, but you choose to delegate that task to someone else so you can enjoy time with your family.

“Personal finance becomes more complicated as you approach retirement.”

Saving for retirement can be challenging, but it doesn’t require much expertise; in fact, 80% of what I know today was learned by reading a handful of consumer (read: not academic) personal finance books in my early 20’s. It also doesn’t take a whole lot of time, especially since technology has made saving automatic and effortless.

As you approach retirement, things change. Most likely, you want to know just how much you can spend in retirement, and that answer can be difficult to produce.

Most of our clients receive a significant portion of their income from a combination of IRAs, nonqualified investments, and Social Security, but these three streams of income have vastly different tax characteristics, and their interdependencies are complex. (These rules change frequently, as well!)

You also may be unsure whether your investments are appropriate, and what will happen if the stock market takes another hit like it did in 2008. When the stock market takes a dive, making the wrong decision could cost you tens of thousands of dollars and could permanently hamstring your retirement income.

Having the expertise and the right tools is important if you want to maximize your after-tax income. Consider also the value of your time: would rather spend time fiddling with your retirement? Or would you rather do the things you love to do?

If you have been DIY’ing your retirement plan thus far, it may not be a bad idea to get a second opinion. Schedule a free consultation with 402 Financial.

About the Author

Joseph Fowler, CFP® is a financial planner and co-owner of 402 Financial in Lincoln, NE.

402 Financial provides financial planning and investment management services to people approaching or in retirement. Joe always acts as a fiduciary and never takes commissions on product sales.

Click this link to schedule a free consultation with Joe.